Overview

Navigating regulatory compliance in the USA is critical for companies in industries governed by bodies like the SEC and FINRA. These regulations safeguard investors and uphold market integrity, yet non-compliance risks hefty fines and reputational damage. While others struggle to manage compliance manually, you’ll be leading with AI-powered solutions to stay ahead.

CHALLENGE

Currently, companies become aware of potential fines or penalties only after violations occur, through legal notices, news reports, or communication from lawyers. This reactive process is slow, cumbersome, and leaves little room for proactive mitigation.

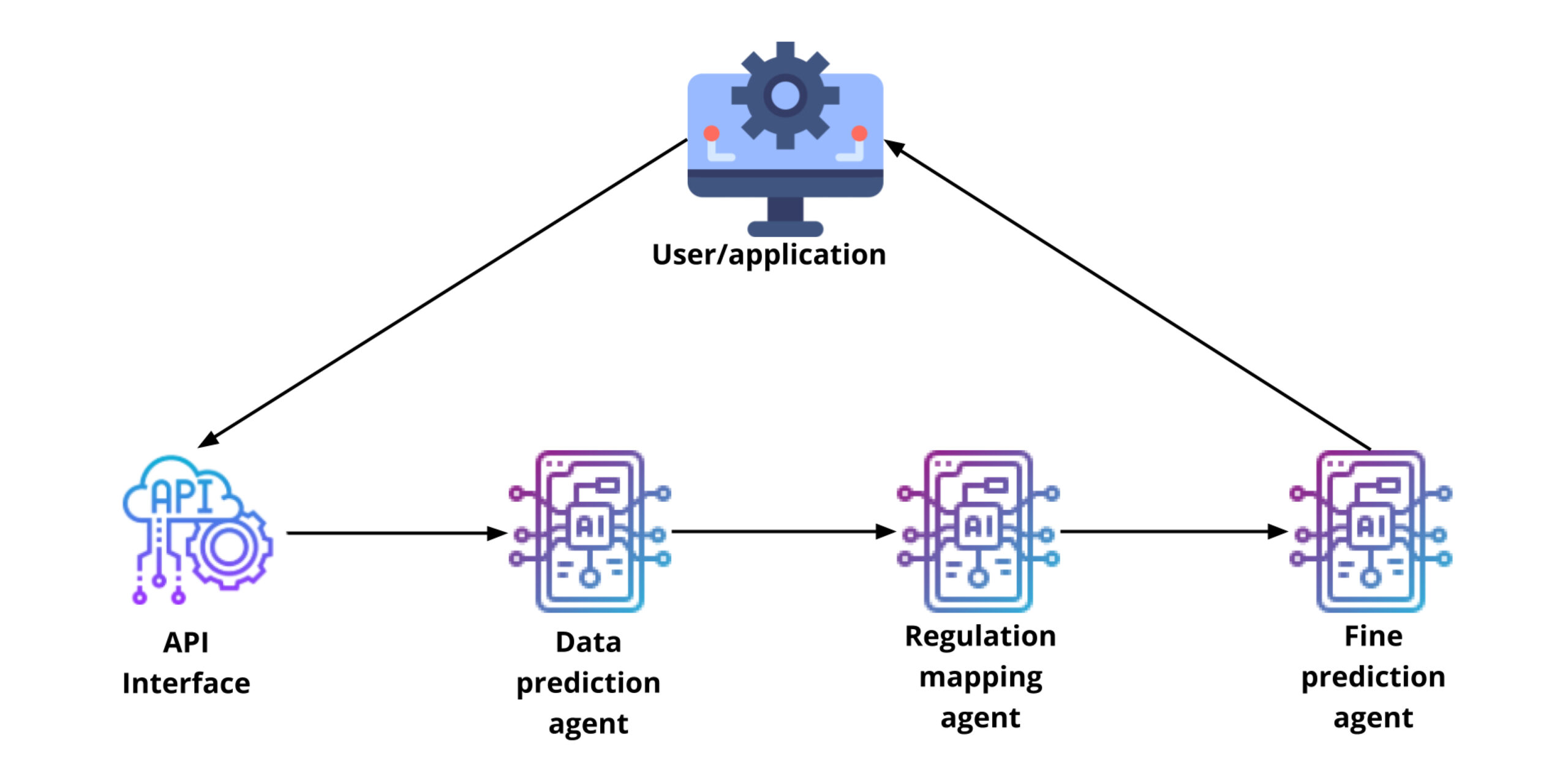

SOLUTION APPROACH

An AI-powered agent that analyzes regulatory frameworks and predicts potential fines or penalties for non-compliance in advance. By leveraging historical data, rule interpretation, and predictive algorithms, the AI agent provides companies with actionable insights to address compliance gaps proactively.

- Proactive Compliance Management: The AI agent predicts potential regulatory issues, enabling preemptive corrective actions to avoid penalties.

- Risk Reduction: Minimizes legal and financial risks by ensuring adherence to SEC and FINRA guidelines.

- Enhanced Operational Efficiency: Automates compliance processes, saving time and reducing manual effort.

- Investor Confidence: Strengthens trust by safeguarding market integrity and maintaining high compliance standards.

- Regulatory Edge: Keeps companies ahead of regulatory changes, positioning them as industry leaders.